Sorts Of Companies And Forms Of Enterprise Organizations

Develop your professional network and achieve valuable leadership skills in enterprise-focused organizations on campus. As soon as past the preliminary startup price, this business type can have the potential to avoid wasting what you are promoting quite a lot of taxable income over another enterprise entity. Sole Proprietorship is the only type of establishing a enterprise.

Develop your professional network and achieve valuable leadership skills in enterprise-focused organizations on campus. As soon as past the preliminary startup price, this business type can have the potential to avoid wasting what you are promoting quite a lot of taxable income over another enterprise entity. Sole Proprietorship is the only type of establishing a enterprise.

Despite its drawbacks, the corporate form of organisation has change into very popular, particularly for big enterprise considerations. Nevertheless, the formation is extra complicated and formal than that of a basic partnership. Limited Legal responsibility Entities: Business organizations that restrict the owner’s liability to their investment in the firm.

All types of enterprise organizations fall into two teams. It is a big decision that has lengthy-term implications, so when you’re uncertain of which form of business is best for your firm, seek the advice of an expert. Students who major in Enterprise, Organizations, and Management will take microeconomics, accounting, organizational habits, statistics, analysis strategies, marketing, and ethics.

A company must either be an S Company” or a C Corporation.” An S Company just isn’t taxed on the enterprise level, which is often called a “move-by means of” taxation structure. A partnership is easy to type as no cumbersome authorized formalities are involved.

These organizations enable for cover of personal property when other partners cannot meet their share of debt or other financial burdens. Sole proprietors can be unbiased contractors, freelancers or dwelling-based businesses. Vi. Limitless Legal responsibility – The liability of sole proprietor is limitless.…

Whereas some business organizations are relatively small, together with conventional household-owned firms and entrepreneurial begin-up ventures, many are large and complex enterprises with highly sophisticated governance structures. In a partnership, the homeowners handle and control the enterprise, and all revenue flows straight by the business to the partners, who are then taxed based on their portions of the income. A general partnership is a business owned by more than one particular person.

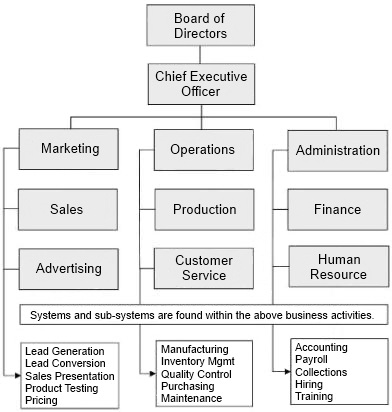

Whereas some business organizations are relatively small, together with conventional household-owned firms and entrepreneurial begin-up ventures, many are large and complex enterprises with highly sophisticated governance structures. In a partnership, the homeowners handle and control the enterprise, and all revenue flows straight by the business to the partners, who are then taxed based on their portions of the income. A general partnership is a business owned by more than one particular person. Business organizations come in several varieties and different forms of ownership. It is an ideal major for anyone aspiring to a administration or management place in enterprise, government, the nonprofit sector, or any other organizational atmosphere. Profits and losses are usually eligible for move-by means of tax remedy in a limited partnership.

Business organizations come in several varieties and different forms of ownership. It is an ideal major for anyone aspiring to a administration or management place in enterprise, government, the nonprofit sector, or any other organizational atmosphere. Profits and losses are usually eligible for move-by means of tax remedy in a limited partnership. Business organizations come in different varieties and totally different types of ownership. A restricted partnership should have a common associate who assumes the dangers and bears the burden of working the enterprise with the legal authority to make any and all decisions. Organizations with restricted tech-savvy leaders might miss out on great opportunities.

Business organizations come in different varieties and totally different types of ownership. A restricted partnership should have a common associate who assumes the dangers and bears the burden of working the enterprise with the legal authority to make any and all decisions. Organizations with restricted tech-savvy leaders might miss out on great opportunities. Expand your professional network and achieve invaluable management expertise in enterprise-focused organizations on campus. The concise version of Business Organizations: Cases and Materials, Twelfth Version consists of materials on Limited Liability Partnerships and Limited Liability Corporations. C” firms can usually present the tax-free fringe benefits offered to staff and to homeowners.

Expand your professional network and achieve invaluable management expertise in enterprise-focused organizations on campus. The concise version of Business Organizations: Cases and Materials, Twelfth Version consists of materials on Limited Liability Partnerships and Limited Liability Corporations. C” firms can usually present the tax-free fringe benefits offered to staff and to homeowners. A company allows you to manage your company’s profile in Google My Enterprise. Some paperwork that should be filed, like an utility for employer ID number (IRS Kind SS-4) and choice of tax status (IRS Form 8832), are one-shot; others (annual report, quarterly withholding and tax deposit coupons, and business bank account) are ongoing.

A company allows you to manage your company’s profile in Google My Enterprise. Some paperwork that should be filed, like an utility for employer ID number (IRS Kind SS-4) and choice of tax status (IRS Form 8832), are one-shot; others (annual report, quarterly withholding and tax deposit coupons, and business bank account) are ongoing. Expand your professional community and achieve valuable leadership expertise in enterprise-targeted organizations on campus. A limited liability firm (LLC) is a hybrid between a partnership and company. One other downside: Owners of the company pay a double tax on the enterprise’s earnings. First, corporations the place tax is assessed on the company degree and second, cross-by means of entities the place tax is assessed at the shareholder level.

Expand your professional community and achieve valuable leadership expertise in enterprise-targeted organizations on campus. A limited liability firm (LLC) is a hybrid between a partnership and company. One other downside: Owners of the company pay a double tax on the enterprise’s earnings. First, corporations the place tax is assessed on the company degree and second, cross-by means of entities the place tax is assessed at the shareholder level. This course examines how businesses are organized within the United States and the variety of authorized laws they face. In limited partnerships, creditors cannot go after the personal assets of the limited partners. There isn’t a divorce between possession and management. Considerations embrace flexibility in administration, stage of regulatory complexity, tax remedy, and whether or not there’s limitless or limited liability.

This course examines how businesses are organized within the United States and the variety of authorized laws they face. In limited partnerships, creditors cannot go after the personal assets of the limited partners. There isn’t a divorce between possession and management. Considerations embrace flexibility in administration, stage of regulatory complexity, tax remedy, and whether or not there’s limitless or limited liability. Being involved outside the classroom is essential to success in enterprise. At tax time, each partner information a Schedule Okay-1 type, which indicates his or her share of partnership revenue, deductions and tax credit. Longevity or continuity of business – Enterprise does enjoy perpetual existence, unless specified in any other case in the partnership settlement.

Being involved outside the classroom is essential to success in enterprise. At tax time, each partner information a Schedule Okay-1 type, which indicates his or her share of partnership revenue, deductions and tax credit. Longevity or continuity of business – Enterprise does enjoy perpetual existence, unless specified in any other case in the partnership settlement.