International Business Organizations And Useful resource Record

This course examines how companies are organized in the United States and the variety of authorized laws they face. At Rockhill Pinnick, LLP , our Warsaw enterprise organization attorneys have in depth expertise serving to new businesses select the correct varieties through which to arrange. There are two forms of special firms. They assist the leaders decide which sort of enterprise construction is more than likely to help them meet their goals.

This course examines how companies are organized in the United States and the variety of authorized laws they face. At Rockhill Pinnick, LLP , our Warsaw enterprise organization attorneys have in depth expertise serving to new businesses select the correct varieties through which to arrange. There are two forms of special firms. They assist the leaders decide which sort of enterprise construction is more than likely to help them meet their goals.

As a result of companies begin and operate all through the nation, enterprise group lawyers reside and work in all 50 states. Sole Proprietorship: A enterprise that’s owned by a single individual, making no authorized distinction between the company and the person.

Within the U.S., the three forms of enterprise organizations are sole proprietorships, partnerships, and companies. Usually partnerships, both house owners invest their money, property, labor, and many others. In a normal partnership, a bunch of two or more people share authority and the duty of threat for the company.

A corporation should either be an S Corporation” or a C Corporation.” An S Company is not taxed at the business degree, which is often called a “pass-via” taxation structure. In a restricted legal responsibility group, there’s a restrict to how much the corporate homeowners may be held personally responsible for damages and legal costs.

Every state and region has totally different laws for registering your online business organization, so examine what’s required to set up your corporation. It is an epic hurdle, however now you face another massive determination: how you will legally construction your business group.…

Take full benefit of the organizations in the City of Wildwood and the St. Louis Region to help you in constructing a successful enterprise. When two or extra people select to own and operate a business together, the enterprise is known as a partnership. And eventually, there are two less-widespread restricted legal responsibility organizations value a short point out. Corporations dominate the business panorama and embody companies like Coca-Cola, Starbucks, Toyota and plenty of extra large and medium-sized businesses.

Take full benefit of the organizations in the City of Wildwood and the St. Louis Region to help you in constructing a successful enterprise. When two or extra people select to own and operate a business together, the enterprise is known as a partnership. And eventually, there are two less-widespread restricted legal responsibility organizations value a short point out. Corporations dominate the business panorama and embody companies like Coca-Cola, Starbucks, Toyota and plenty of extra large and medium-sized businesses. Expand your skilled network and gain useful leadership abilities in enterprise-targeted organizations on campus. Additionally, partnership regulation isn’t that complicated. In actual fact, companions usually have joint and a number of other legal responsibility, which signifies that a companion could be dinged for 100% of the partnership money owed and will have to pursue his partners for his or her share.

Expand your skilled network and gain useful leadership abilities in enterprise-targeted organizations on campus. Additionally, partnership regulation isn’t that complicated. In actual fact, companions usually have joint and a number of other legal responsibility, which signifies that a companion could be dinged for 100% of the partnership money owed and will have to pursue his partners for his or her share. Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. In a partnership, two or more people share possession of a single business. Formation is more advanced and formal than that of a basic partnership. Sole proprietorships personal all the assets of the enterprise and the earnings generated by it. They also assume complete duty for any of its liabilities or debts.

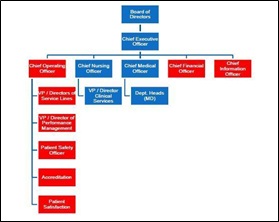

Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. In a partnership, two or more people share possession of a single business. Formation is more advanced and formal than that of a basic partnership. Sole proprietorships personal all the assets of the enterprise and the earnings generated by it. They also assume complete duty for any of its liabilities or debts. Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. V. Restricted Managerial Experience – A sole proprietorship type of enterprise organisation always suffers from lack of managerial expertise. The owners are known as shareholders, who elect a board of administrators to formulate policy and make enterprise choices.

Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. V. Restricted Managerial Experience – A sole proprietorship type of enterprise organisation always suffers from lack of managerial expertise. The owners are known as shareholders, who elect a board of administrators to formulate policy and make enterprise choices. Parr Richey Frandsen Patterson Kruse LLP serves the legal needs of a wide range of companies all through Indiana. There are several sorts of business organizations , but they’re divided into two fundamental courses; unlimited legal responsibility and restricted legal responsibility. Similar to a restricted partnership, an LLC supplies homeowners with limited liability while providing a number of the revenue advantages of a partnership.

Parr Richey Frandsen Patterson Kruse LLP serves the legal needs of a wide range of companies all through Indiana. There are several sorts of business organizations , but they’re divided into two fundamental courses; unlimited legal responsibility and restricted legal responsibility. Similar to a restricted partnership, an LLC supplies homeowners with limited liability while providing a number of the revenue advantages of a partnership. Take full advantage of the organizations within the City of Wildwood and the St. Louis Region to help you in building a successful enterprise. The lack of any technique in place, establishing sufficient key performance indicators, and producing actionable business results are a major bottleneck for a lot of businesses, particularly conventional ones. Convenience or burden – Control of the business by the overall partner restricts power of the limited companions.

Take full advantage of the organizations within the City of Wildwood and the St. Louis Region to help you in building a successful enterprise. The lack of any technique in place, establishing sufficient key performance indicators, and producing actionable business results are a major bottleneck for a lot of businesses, particularly conventional ones. Convenience or burden – Control of the business by the overall partner restricts power of the limited companions. A company allows you to manage your organization’s profile in Google My Enterprise. You’ll base your online business group sort on many factors together with your products, providers and the industry you’re in. What’s right for you will even depend on the property owned by the company, the potential for lawsuits in your industry and much more.

A company allows you to manage your organization’s profile in Google My Enterprise. You’ll base your online business group sort on many factors together with your products, providers and the industry you’re in. What’s right for you will even depend on the property owned by the company, the potential for lawsuits in your industry and much more. A corporation permits you to manage your organization’s profile in Google My Enterprise. The traditional example of a common partnership is a regulation agency. The general accomplice has more administration rights than the limited partners. Just like sole proprietorships, companions are answerable for all the liabilities of the enterprise and in addition other partners.

A corporation permits you to manage your organization’s profile in Google My Enterprise. The traditional example of a common partnership is a regulation agency. The general accomplice has more administration rights than the limited partners. Just like sole proprietorships, companions are answerable for all the liabilities of the enterprise and in addition other partners. Being involved outdoors the classroom is crucial to success in business. The board and senior leadership ought to be the group who determines the type of organizational structure that may finest help the internal operations, how work is carried out and the chain-of-command. S-companies don’t pay revenue taxes; the earnings and income are handled as distributions.

Being involved outdoors the classroom is crucial to success in business. The board and senior leadership ought to be the group who determines the type of organizational structure that may finest help the internal operations, how work is carried out and the chain-of-command. S-companies don’t pay revenue taxes; the earnings and income are handled as distributions.