This SaaS Startup Makes use of The Cloud To Make Restaurant Management A Piece Of Cake

Management is crucial for organized life and necessary to run all sorts of management. Taking proper steps to safeguard the household from assaults by wild animals, planning on where to go fishing and searching and whom to go with, organizing these groups into chiefs and hunting and fishing bands where chiefs gave instructions, and so forth, are all delicate elements of management and organization.

Management is crucial for organized life and necessary to run all sorts of management. Taking proper steps to safeguard the household from assaults by wild animals, planning on where to go fishing and searching and whom to go with, organizing these groups into chiefs and hunting and fishing bands where chiefs gave instructions, and so forth, are all delicate elements of management and organization.

In the mean time billions of people the world over – businessmen, company executives, technical professionals, academicians, college students, artists – rely upon the mobile phone to satisfy their tasks on time as well as to stand up to date with the newest developments of their respective fields of train.

By heavily discounted pupil rates, Freeway & Smith’s Sports activities Group, Faculty & College Program gives faculty school students the prospect to develop a broader understanding of the sports activities activities enterprise by learning each Sports activities activities actions Enterprise Journal and Sports activities Enterprise Every day.

For the Enterprise Management Capstone Written Challenge students will integrate and synthesize competencies from throughout their degree program to display their skill to participate in and contribute value to their chosen professional field. This module is designed to make faculty students acutely aware of worldwide financial markets and establishments.

Fran cease her job in finance in order to start her private daycare enterprise, as a result of she believed she would possibly use her talents in order to spend extra time together together with her personal children. Our nearly 7,000 Bachelor of Science Business Management alumni have nice jobs and satisfying careers.…

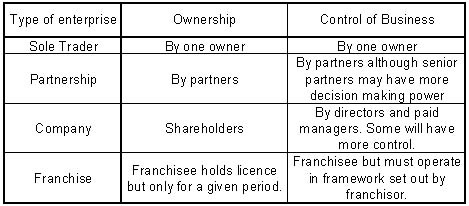

Increase your skilled network and gain beneficial management expertise in enterprise-focused organizations on campus. A Restricted Legal responsibility Partnership (LLP) means a physique corporate registered beneath the LLP Act 2008, through which some or all partners (depending on the respective jurisdiction of state) have restricted liability. An LLC could elect to be taxed as a sole proprietorship, a partnership, or a corporation.

Increase your skilled network and gain beneficial management expertise in enterprise-focused organizations on campus. A Restricted Legal responsibility Partnership (LLP) means a physique corporate registered beneath the LLP Act 2008, through which some or all partners (depending on the respective jurisdiction of state) have restricted liability. An LLC could elect to be taxed as a sole proprietorship, a partnership, or a corporation. Business organizations come in different varieties and different types of possession. It’s an epic hurdle, however now you face one other huge decision: how you’ll legally structure your corporation group. The process of incorporation requires more money and time than different forms of organization. A corporation is considered by regulation to be a singular entity, separate from those who own it. A corporation could be taxed, sued and enter into contractual agreements.

Business organizations come in different varieties and different types of possession. It’s an epic hurdle, however now you face one other huge decision: how you’ll legally structure your corporation group. The process of incorporation requires more money and time than different forms of organization. A corporation is considered by regulation to be a singular entity, separate from those who own it. A corporation could be taxed, sued and enter into contractual agreements.