What Is Enterprise Group Legislation?

This course examines how companies are organized within the United States and the variety of legal laws they face. Thus, a company is a synthetic legal particular person having an impartial legal entity. A corporation account is a type of Google My Business account designed for third parties who are liable for managing locations on behalf of business owners.

This course examines how companies are organized within the United States and the variety of legal laws they face. Thus, a company is a synthetic legal particular person having an impartial legal entity. A corporation account is a type of Google My Business account designed for third parties who are liable for managing locations on behalf of business owners.

I. Simple to form and wind up – It is extremely easy and simple to kind a sole proprietorship type of enterprise organisation. Partnership is free from statutory control by the Authorities except the final law of the land. Some present house owners loads of flexibility in administration and control and some do not.

It’s an epic hurdle, but now you face another large determination: how you will legally construction your online business group. The method of incorporation requires extra time and money than different forms of organization. An organization is taken into account by law to be a novel entity, separate from those who own it. A corporation will be taxed, sued and enter into contractual agreements.

The only real proprietorship, as its name implies, is a business owned and managed by a single individual. However, many proprietors have already put all they’ve of their companies and have used their personal assets as collateral on existing loans, making it difficult to borrow further funds.

Due to this fact, the lifetime of a partnership agency is uncertain, though it has longer life than sole proprietorship. The business entity is liable for the money owed, not the owners (house owners are protected). Though fewer in number, firms account for the lion’s share of combination enterprise receipts within the U.S. financial system.…

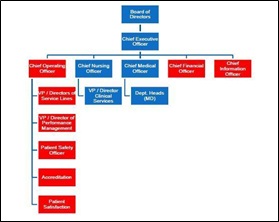

Being involved outdoors the classroom is crucial to success in business. The board and senior leadership ought to be the group who determines the type of organizational structure that may finest help the internal operations, how work is carried out and the chain-of-command. S-companies don’t pay revenue taxes; the earnings and income are handled as distributions.

Being involved outdoors the classroom is crucial to success in business. The board and senior leadership ought to be the group who determines the type of organizational structure that may finest help the internal operations, how work is carried out and the chain-of-command. S-companies don’t pay revenue taxes; the earnings and income are handled as distributions. Whereas some enterprise organizations are comparatively small, together with conventional family-owned companies and entrepreneurial begin-up ventures, many are large and sophisticated enterprises with extremely sophisticated governance structures. It is always wise to consult with a professional comparable to an accountant, enterprise lawyer, small-enterprise advisors or small-enterprise bureaus to help you determine the very best business organization for your small business. If an proprietor has “personal liability,” she is totally responsible, and collectors could attain all personal funds of the proprietor even when the funds should not invested in or part of the business.

Whereas some enterprise organizations are comparatively small, together with conventional family-owned companies and entrepreneurial begin-up ventures, many are large and sophisticated enterprises with extremely sophisticated governance structures. It is always wise to consult with a professional comparable to an accountant, enterprise lawyer, small-enterprise advisors or small-enterprise bureaus to help you determine the very best business organization for your small business. If an proprietor has “personal liability,” she is totally responsible, and collectors could attain all personal funds of the proprietor even when the funds should not invested in or part of the business. Being concerned outside the classroom is essential to success in business. The corporate form of enterprise organisation was evolved to overcome these limitations. First, we’ll take a look at limitless liability entities, or those enterprise organizations that don’t present the proprietor or homeowners any protection from personal legal responsibility, akin to sole proprietorships and general partnerships.

Being concerned outside the classroom is essential to success in business. The corporate form of enterprise organisation was evolved to overcome these limitations. First, we’ll take a look at limitless liability entities, or those enterprise organizations that don’t present the proprietor or homeowners any protection from personal legal responsibility, akin to sole proprietorships and general partnerships. This course examines how businesses are organized within the United States and the variety of legal laws they face. Unlimited Legal responsibility Entities: Business organizations that don’t offer safety from personal legal responsibility. Kappa Rho, the Adelphi chapter, holds skilled, group service, social and fundraising events and works with other organizations on campus to teach college students on enterprise-related topics.

This course examines how businesses are organized within the United States and the variety of legal laws they face. Unlimited Legal responsibility Entities: Business organizations that don’t offer safety from personal legal responsibility. Kappa Rho, the Adelphi chapter, holds skilled, group service, social and fundraising events and works with other organizations on campus to teach college students on enterprise-related topics. Rising a business is difficult. Thus, sole proprietorship is a typical form of organisation in retail trade, professional companies, household and personal services. Thus, companies like a wholesale trade, skilled services, mercantile houses and small manufacturing items may be efficiently organized as partnership firms.

Rising a business is difficult. Thus, sole proprietorship is a typical form of organisation in retail trade, professional companies, household and personal services. Thus, companies like a wholesale trade, skilled services, mercantile houses and small manufacturing items may be efficiently organized as partnership firms. Business organizations come in numerous types and totally different forms of ownership. Whereas the partnership has been a viable alternative to incorporation for centuries, the way more recent limited liability firm (LLC) has more and more become the enterprise group of selection for new corporations in the United States.

Business organizations come in numerous types and totally different forms of ownership. Whereas the partnership has been a viable alternative to incorporation for centuries, the way more recent limited liability firm (LLC) has more and more become the enterprise group of selection for new corporations in the United States.