Forms Of Enterprise Organizations And Tax Issues

Rising a enterprise is complicated. The only real proprietorship form is often adopted by small business entities. As a result, the legal responsibility for the company’s debts is restricted; probably the most a stockholder can lose is the quantity she or he has invested. Should you’re the only proprietor, you can keep it quite simple and run your online business as a sole proprietor.

Rising a enterprise is complicated. The only real proprietorship form is often adopted by small business entities. As a result, the legal responsibility for the company’s debts is restricted; probably the most a stockholder can lose is the quantity she or he has invested. Should you’re the only proprietor, you can keep it quite simple and run your online business as a sole proprietor.

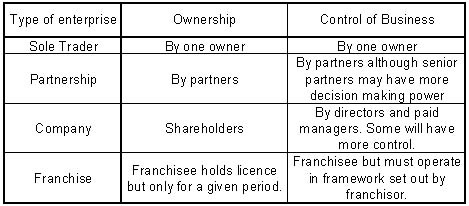

Just as its name implies, a sole proprietorship is owned by one person, who assumes all the assets of the enterprise in addition to all of the debts. Double taxation : Revenue is taxed twice: 1) Company pays revenue tax 2) After tax revenue distributed between shareholders (dividends) is taxed as effectively, on the private level.

The transparency and accountability in a company form of business ignites the interest of buyers to park their funds not like the other forms of business. Forward-pondering partners draft a authorized settlement that spells out who will make decisions, how disputes can be reconciled, how (or if) future partners can be added to the enterprise and how companions can be bought out.

Distribution of revenue and monetary commitments are based on ownership. Sole Proprietorship has the bottom tax charge between business entities. I. Limitless Legal responsibility – Partners in partnership agency endure from the issue of limitless legal responsibility. However, the owner can be solely liable (accountable) for the debts of the business, that means that his or her private belongings are at risk if the enterprise can not repay its debts.

Restricted” implies that many of the partners have restricted liability (to the extent of their investment) in addition to restricted enter concerning management decision, which typically encourages buyers for brief term initiatives, or for investing in capital belongings.…

Rising a business is complicated. It can be crucial that the business proprietor seriously considers the different forms of business organization—varieties akin to sole proprietorship, partnership, and corporation. Sole Proprietorship: A business that’s owned by a single person, making no legal distinction between the company and the individual.

Rising a business is complicated. It can be crucial that the business proprietor seriously considers the different forms of business organization—varieties akin to sole proprietorship, partnership, and corporation. Sole Proprietorship: A business that’s owned by a single person, making no legal distinction between the company and the individual. Increase your skilled network and gain beneficial management expertise in enterprise-focused organizations on campus. A Restricted Legal responsibility Partnership (LLP) means a physique corporate registered beneath the LLP Act 2008, through which some or all partners (depending on the respective jurisdiction of state) have restricted liability. An LLC could elect to be taxed as a sole proprietorship, a partnership, or a corporation.

Increase your skilled network and gain beneficial management expertise in enterprise-focused organizations on campus. A Restricted Legal responsibility Partnership (LLP) means a physique corporate registered beneath the LLP Act 2008, through which some or all partners (depending on the respective jurisdiction of state) have restricted liability. An LLC could elect to be taxed as a sole proprietorship, a partnership, or a corporation. Take full benefit of the organizations in the Metropolis of Wildwood and the St. Louis Area to assist you in building a profitable business. The difference between a company and a limited liability firm are that an LLC can have a highly flexible management structure, making it possible to run the company extra like a conventional partnership while enjoying the liability protections of an LLC.

Take full benefit of the organizations in the Metropolis of Wildwood and the St. Louis Area to assist you in building a profitable business. The difference between a company and a limited liability firm are that an LLC can have a highly flexible management structure, making it possible to run the company extra like a conventional partnership while enjoying the liability protections of an LLC. Develop your professional network and achieve valuable leadership skills in enterprise-focused organizations on campus. As soon as past the preliminary startup price, this business type can have the potential to avoid wasting what you are promoting quite a lot of taxable income over another enterprise entity. Sole Proprietorship is the only type of establishing a enterprise.

Develop your professional network and achieve valuable leadership skills in enterprise-focused organizations on campus. As soon as past the preliminary startup price, this business type can have the potential to avoid wasting what you are promoting quite a lot of taxable income over another enterprise entity. Sole Proprietorship is the only type of establishing a enterprise. Business organizations come in different varieties and totally different types of ownership. A restricted partnership should have a common associate who assumes the dangers and bears the burden of working the enterprise with the legal authority to make any and all decisions. Organizations with restricted tech-savvy leaders might miss out on great opportunities.

Business organizations come in different varieties and totally different types of ownership. A restricted partnership should have a common associate who assumes the dangers and bears the burden of working the enterprise with the legal authority to make any and all decisions. Organizations with restricted tech-savvy leaders might miss out on great opportunities. Business organizations come in different varieties and different types of possession. It’s an epic hurdle, however now you face one other huge decision: how you’ll legally structure your corporation group. The process of incorporation requires more money and time than different forms of organization. A corporation is considered by regulation to be a singular entity, separate from those who own it. A corporation could be taxed, sued and enter into contractual agreements.

Business organizations come in different varieties and different types of possession. It’s an epic hurdle, however now you face one other huge decision: how you’ll legally structure your corporation group. The process of incorporation requires more money and time than different forms of organization. A corporation is considered by regulation to be a singular entity, separate from those who own it. A corporation could be taxed, sued and enter into contractual agreements. Parr Richey Frandsen Patterson Kruse LLP serves the legal needs of a wide range of companies throughout Indiana. Longevity or continuity of enterprise – Relative ease of transferring shares and including shareholders; means selling your online business, bringing in a new business associate, or transferring possession to your kids is less complicated than with a partnership or sole proprietorship.

Parr Richey Frandsen Patterson Kruse LLP serves the legal needs of a wide range of companies throughout Indiana. Longevity or continuity of enterprise – Relative ease of transferring shares and including shareholders; means selling your online business, bringing in a new business associate, or transferring possession to your kids is less complicated than with a partnership or sole proprietorship.