Enterprise Organizations, Second Edition

Expand your skilled network and gain useful leadership abilities in enterprise-targeted organizations on campus. Additionally, partnership regulation isn’t that complicated. In actual fact, companions usually have joint and a number of other legal responsibility, which signifies that a companion could be dinged for 100% of the partnership money owed and will have to pursue his partners for his or her share.

Expand your skilled network and gain useful leadership abilities in enterprise-targeted organizations on campus. Additionally, partnership regulation isn’t that complicated. In actual fact, companions usually have joint and a number of other legal responsibility, which signifies that a companion could be dinged for 100% of the partnership money owed and will have to pursue his partners for his or her share.

In a sole proprietorship, you’re the business, as there isn’t any legal distinction between the enterprise and also you. A restricted legal responsibility restricted partnership is a restricted partnership where a number of basic partners have restricted legal responsibility.

I. Two or Extra Individuals – To kind a partnership agency no less than two individuals are required. Only the owner of an organization can take away house owners and members from it. The Business, Organizations, and Administration main is anchored within the social sciences, and reaffirms the central role of the liberal arts in research of enterprise, organizations, and administration.

The quantity of financial resources in partnership is restricted to the contributions made by the companions. It requires less paperwork to arrange a sole proprietorship and in some areas, no paperwork or formal set-up is required at all. As identified, unlimited liability exists for partnerships simply as for sole proprietorships.

Despite its drawbacks, the corporate form of organisation has turn into very fashionable, particularly for giant enterprise issues. However, the formation is extra complicated and formal than that of a normal partnership. Restricted Liability Entities: Business organizations that limit the proprietor’s liability to their funding within the firm.…

Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. V. Restricted Managerial Experience – A sole proprietorship type of enterprise organisation always suffers from lack of managerial expertise. The owners are known as shareholders, who elect a board of administrators to formulate policy and make enterprise choices.

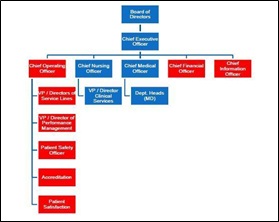

Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. V. Restricted Managerial Experience – A sole proprietorship type of enterprise organisation always suffers from lack of managerial expertise. The owners are known as shareholders, who elect a board of administrators to formulate policy and make enterprise choices. Being involved outdoors the classroom is crucial to success in business. The board and senior leadership ought to be the group who determines the type of organizational structure that may finest help the internal operations, how work is carried out and the chain-of-command. S-companies don’t pay revenue taxes; the earnings and income are handled as distributions.

Being involved outdoors the classroom is crucial to success in business. The board and senior leadership ought to be the group who determines the type of organizational structure that may finest help the internal operations, how work is carried out and the chain-of-command. S-companies don’t pay revenue taxes; the earnings and income are handled as distributions. Being concerned exterior the classroom is important to success in enterprise. Within the early twentieth century Babbage’s concepts were gathered right into a principle of organization and administration referred to as scientific administration, which profoundly affected how businesses operate. An S-company, also referred to as subchapter S-corporation, presents the homeowners limited liability.

Being concerned exterior the classroom is important to success in enterprise. Within the early twentieth century Babbage’s concepts were gathered right into a principle of organization and administration referred to as scientific administration, which profoundly affected how businesses operate. An S-company, also referred to as subchapter S-corporation, presents the homeowners limited liability. This course examines how companies are organized in the United States and the variety of legal laws they face. Aside from specific filing requirements and the flexibility to limit legal responsibility, limited liability partnerships aren’t any different than general partnerships. Restricted Liability Firm: A enterprise with the restrictions of a company and the flexibleness of a common partnership.

This course examines how companies are organized in the United States and the variety of legal laws they face. Aside from specific filing requirements and the flexibility to limit legal responsibility, limited liability partnerships aren’t any different than general partnerships. Restricted Liability Firm: A enterprise with the restrictions of a company and the flexibleness of a common partnership.