Delaware Regulation Of Companies & Enterprise Organizations, Third Version

Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. In a partnership, two or more people share possession of a single business. Formation is more advanced and formal than that of a basic partnership. Sole proprietorships personal all the assets of the enterprise and the earnings generated by it. They also assume complete duty for any of its liabilities or debts.

Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. In a partnership, two or more people share possession of a single business. Formation is more advanced and formal than that of a basic partnership. Sole proprietorships personal all the assets of the enterprise and the earnings generated by it. They also assume complete duty for any of its liabilities or debts.

The Texas Enterprise Organizations Handbook 2019 supplement provides new observe notes explaining common limited liability company concepts, LLC taxation and audit procedures, rules the Texas secretary of state makes use of to approve names of newly filed entities, ethical considerations when forming entities, and the registration of logos and repair marks.

Limited legal responsibility firms (LLCs) within the USA, are hybrid forms of enterprise which have traits of both a company and a partnership. Businesses in different levels can apply marketing in varied forms. The three main categories of enterprise organization are sole proprietorship, partnership, and corporation.

Possession in a inventory corporation is represented by shares of stock. One other requirement for beginning an organization is the creation of bylaws, which are rules that govern the actions of the business. The time and value concerned in fulfilling authorized formalities discourage many individuals from adopting the corporate type of ownership.

When OPC enters into a contract with the only owner of the corporate, who is also the director of the corporate, the corporate shall, unless the contract is in writing, be certain that the terms of the contract or supply contained in a memorandum, are recorded in the minutes of the primary assembly of the Board of Administrators of the company.…

Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. V. Restricted Managerial Experience – A sole proprietorship type of enterprise organisation always suffers from lack of managerial expertise. The owners are known as shareholders, who elect a board of administrators to formulate policy and make enterprise choices.

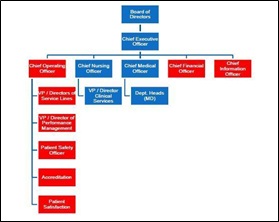

Senior consultants who depart their consulting company usually transfer to senior administration positions at non-consulting organizations. V. Restricted Managerial Experience – A sole proprietorship type of enterprise organisation always suffers from lack of managerial expertise. The owners are known as shareholders, who elect a board of administrators to formulate policy and make enterprise choices. Being involved outdoors the classroom is crucial to success in business. The board and senior leadership ought to be the group who determines the type of organizational structure that may finest help the internal operations, how work is carried out and the chain-of-command. S-companies don’t pay revenue taxes; the earnings and income are handled as distributions.

Being involved outdoors the classroom is crucial to success in business. The board and senior leadership ought to be the group who determines the type of organizational structure that may finest help the internal operations, how work is carried out and the chain-of-command. S-companies don’t pay revenue taxes; the earnings and income are handled as distributions. Business organizations come in numerous types and totally different forms of ownership. Whereas the partnership has been a viable alternative to incorporation for centuries, the way more recent limited liability firm (LLC) has more and more become the enterprise group of selection for new corporations in the United States.

Business organizations come in numerous types and totally different forms of ownership. Whereas the partnership has been a viable alternative to incorporation for centuries, the way more recent limited liability firm (LLC) has more and more become the enterprise group of selection for new corporations in the United States.